Common Framework Reduces Risk

Experience the MarketView Difference

Many organizations continue to have different data collection and management systems for their front office and risk group leading to poor risk assessments. MarketView is the only solution that provides a common data framework between the front and mid-office, improving communication and providing a single “golden source” of data to ensure that calculated and actual risk are the same. MarketView’s seamless integration with downstream risk and settlement systems also ensures that this benefit is passed on and reflected in a better verification of risk across an organization.

Data Quality Assured

Risk managers have come to realize that high-quality market data is as critical to success as the models they feed. MarketView Data Integration Solutions remove the data quality worry with continuous real-time monitoring and dependable and secure feeds. Automated data collection and integration either with MarketView Data Integration Solutions or the Prop Data Hub, also guarantees that risk is not introduced through manual input errors.

Data Integration Solutions

Reliable and simple collaboration between teams and office systems is an important factor for all involved departments. MarketView's Data Integration Solutions allow users to receive the same commodity market data in a consistent format, from a single source.

- Retrieve real-time, intraday, and historical datasets and import proprietary market data and news through MarketView XML API.

- Connect and restore market data in just a few lines of code through MarketView .NET API.

- Integrate real-time quotes, historical time series data, and popular analysis tools such as MATLAB® through our open architecture.

- Schedule an automated service that provides a convenient and reliable source for accessing all of GlobalView's data delivered in a consistent format through MarketView DataExtract.

- Access all internal and external data from a single source through MarketView DataImport

- Update and distribute proprietary information in real-time through a powerful browser-based data input tool, MarketView Xchange.

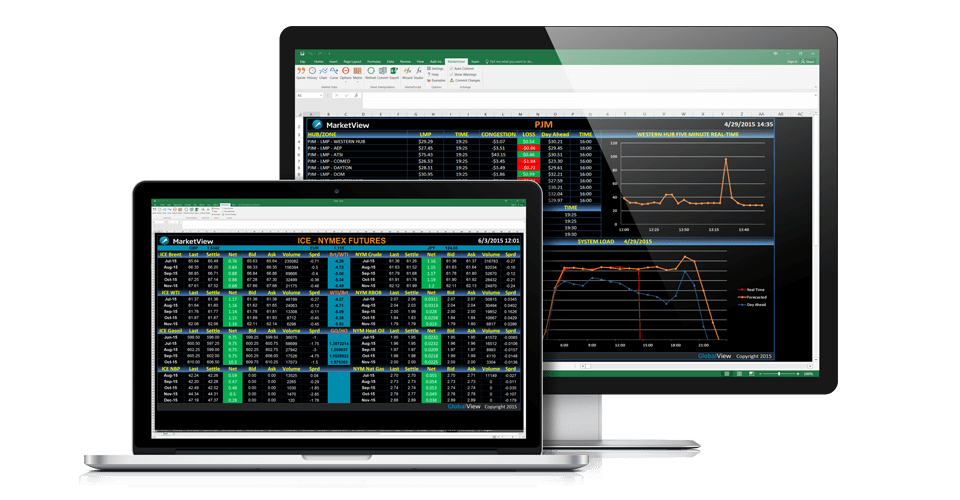

MarketView® ExcelTools for Risk Management

MarketView ExcelTools efficiently automates the delivery of both real-time and historical market data into Excel spreadsheets. ExcelTools dramatically decreases the potential for complex calculation errors such as Value at Risk (VAR) that require time-consuming manual inputs for entries and formulas. Excel remains a powerful, flexible and simple tool and MarketView ExcelTools enhances its value while minimizing the risk that comes with using it.

- Input and analyze data in Excel by linking to real-time data feeds, historical and fundamental data repositories, proprietary data servers, and other upstream and downstream applications to ensure you have access to all data sources at any given time.

- Access real-time publication data tick-by-tick.

- Embed deep historical market information into your spreadsheets with automated data filling methods, units and currency conversion, as well as historical chart creation.

- Plot a forward curve to view the full extension of forward months for an underlying futures contract.

- Easily view a single option strike or a range of options for an underlying futures contract.