| |

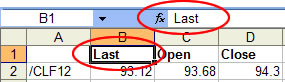

When an options query is placed on an Excel spreadsheet, ExcelTools uses a "field ID" to identify the data to place in the cell. When using Plain or Bold Headers, the header identifies the data field:

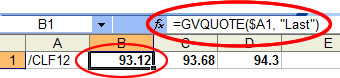

When using No Headers, the Field ID is embedded in the function. In this example, "Last" is the Field ID:

- Fields have a number of alias names. "Last", "Last Price", " p", "price", "lastprice" all reference the same data.

- Field IDs can be entered with capitalization or lowercase. "Open Interest", "open interest", "Open interest", and "OPEN INTEREST" are all used to reference the same data.

- Use of a space between words is optional. "PERCENT CHANGE" and "PERCENT CHANGE" reference the same data.

Data fields are specified for both Put and Call symbols.

| Display Field |

Description |

Field IDs (FIDs) |

|

Symbol

|

The full symbol designation for the option.

|

Symbol |

|

ImpVol

|

Implied Volatility is a statistical measure of the dispersion of returns for a given security or market index. Volatility can either be measured by using the standard deviation or variance between returns from that same security or market index. Commonly, the higher the volatility, the riskier the security.

|

ImpVol |

|

TheoVal

|

Fair Value, or Theoretical Value.

|

TheoVal |

|

Delta

|

Delta is a measure of the change in an options price resulting from a change in the underlying commodity. The value of delta should range from -100.00 to 0 for puts and 0 to 100 for calls.

|

Delta |

|

Gamma

|

Gamma measures the rate of change of delta. Gamma is smallest for deep out of the money and deep in the money options. Gamma is highest when the option gets near the money.

|

Gamma |

|

Rho

|

Rho represents the rate at which the price of a derivative changes relative to a change in the risk free rate of interest. Rho measures the sensitivity of an option to a change in interest rate.

|

Rho |

|

Theta

|

Theta measures the rate of decline in the value of an option due to the passage of time. Theta can also be referred to as the time decay on the value of an option. If everything is held constant, then the option will lose value as time moves closer to the maturity of the option.

|

Theta |

|

Vega

|

Vega represents the amount that the price of an option will change compared to a 1% change in Volatility.

|

Vega |

|

Strike

|

Strike Price is the dividing column between the Put and Call data. The At The Money row is automatically highlighted.

|

Strike |

Source: http://investopedia.com

|